Unaudited financial results of Hepsor AS for 12 months and Q4 2021

BackHepsor AS consolidated sales revenue for the 2021 financial year amounted to 15 million euros and its net profit was 1.7 million euros (including 0.02 million euros attributable to the owners of the parent). We forecast a turnover of 28 million euros in 2022 and net profit of 3.3 million euros (including 3.1 million euros attributable to the owners of the parent).

The company’s financial result in 2021 was lower than in 2020, mainly due to the cyclical nature of the business. The development cycle of projects lasts 24 to 36 months and sales revenue is only generated at the end of cycle. Therefore, more projects may end in one year than in another, and in 2021 fewer than usual projects became ready for sale.

Henri Laks, member of Management Board of Hepsor management board member ,said that due to the cyclical nature of the business, Hepsor may also in the future experience financial years with fluctuating financial results, despite of strong development portfolio and good profitability of the projects. He said that as a reulst the financial results may be weaker or stronger compared with the previous or subsequent financial year. Therefore, the management analyses the company’s long-term financial results using three-year average financial data as a benchmark for neutralising the cyclicality.

The company has set a target of 100 million euros in equity by 2030. To this end, the average annual return on capital should be around 20%. When assessing the return on capital in the coming years, it should be borne in mind that the additional capital raised through the public offering at the end of 2021 will be invested in projects in the first half of 2022, and it will have an effect on the financial results in about 24 months.

Hepsor acquired nine new development projects (five in Estonia and four in Latvia), adding almost 70,000 square metres of new development volume. At the same time, Hepsor’s portfolio is not concentrated into a few individual projects; instead, it is divided between a large number of projects in terms of location and purpose (residential v. commercial). While Hepsor had 19 different projects at the beginning of 2021, that number had grown to 26 by the end of the year. The Group considers the composition of the portfolio to be very good.

According to the member of Management Board, Henri Laks, the management is pleased with the 2021 financial year – a good foundation has been laid for the growth in the coming periods, including strong portfolio, motivated team and thousands of new shareholders on board.

Overview of financial results for 12 months and Q4 of 2021

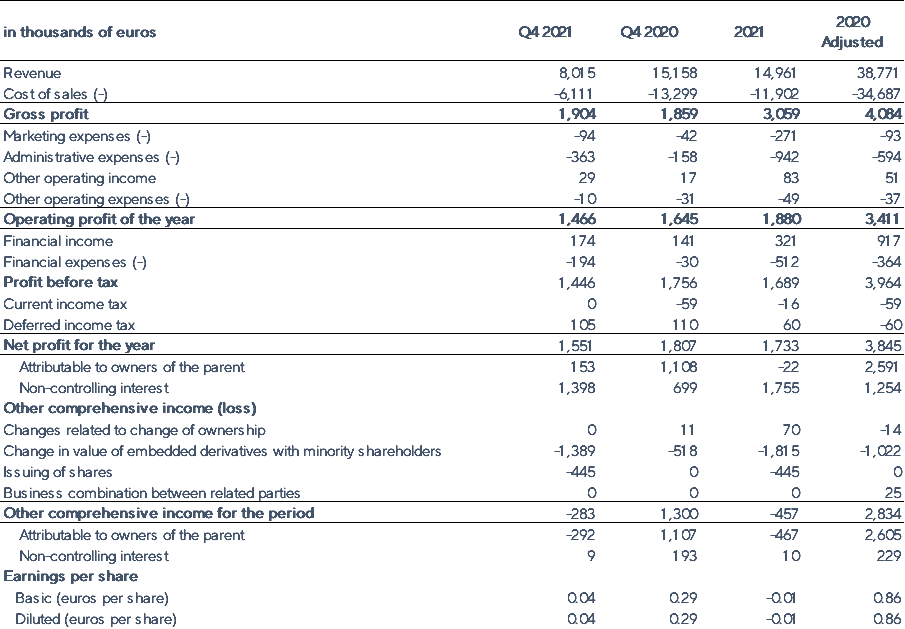

The Group’s sales revenue in 2021 was 15.0 million euros (compared with 38.8 million euros in 2020), of which 8.0 million euros was earned in the fourth quarter (15.2 million euros in the fourth quarter of 2020). Compared with the previous period, sales revenue in 2021 decreased by 61.4%. The decrease in revenue in 2021 was mainly due to the small number of completed projects, which resulted in fewer projects reaching the sales stage than in an average year.

The Group’s operating profit for 2021 amounted to 1.9 million euros (compared with 3.4 million euros in 2020). The operating margin was 12.6% (compared with 8.8% in 2020). The Group’s net profit for the reporting year amounted to 1.7 million euros (compared with 3.8 million euros in 2020), of which the losses attributable to the owners of the parent amounted to 22 thousand euros (profit 2.6 million euros in 2020), while the profit to non-controlling interest was 1.8 million euros (1.3 million euros in 2020).

The Group’s operating profit for the fourth quarter of 2021 was 1.5 million euros (compared with 1.6 million euros in the fourth quarter of 2020). The operating margin for the fourth quarter was 18.3% (compared with 10.9% in the fourth quarter of 2020). The increase in real estate market prices in 2021 compared with 2020 has increased both the operating profit of the sold development projects and the net profit margin. Net profit for the fourth quarter was 1.6 million euros (compared with 1.8 million euros in the fourth quarter of 2020) and the net profit margin was 19.4% (11.9% in 2020).

Although the margins of projects completed during the reporting period were higher than expected, the reporting year ended with a loss for the owners of the parent company. The main reasons are the following:

- Due to the cyclical nature of the projects, very few projects ended during the reporting year.

- The parent company’s share in the projects completed in the reporting year was below average compared with the other projects developed by the parent company.

- Extraordinary expenses arising from the initial public offering of Hepsor AS shares in the amount of 205 thousand euros are included in the operating expenses for the reporting year. The total expenses incurred in relation to the listing and issuing of shares amounted to 650 thousand euros, of which 445 thousand euros have been reflected in the consolidated income statement.

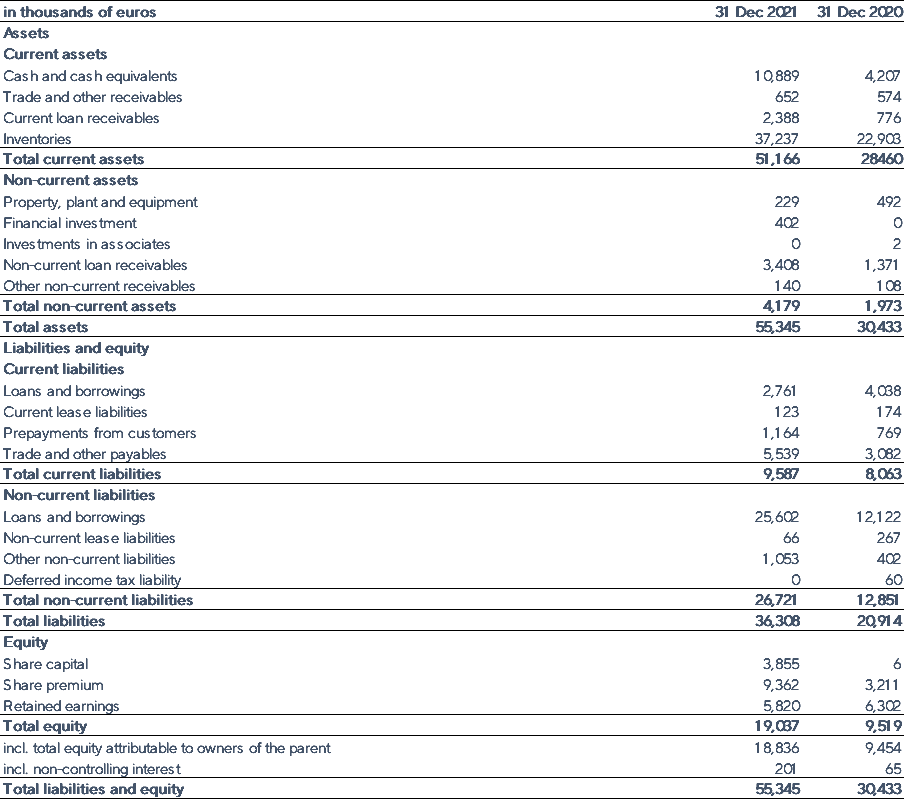

Consolidated statement of financial position (unaudited)

Consolidated statement of profit and loss and other comprehensive income (unaudited)

Please find the reports from webpage https://hepsor.ee/en/for-investors/stock/investor-calendar/